|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

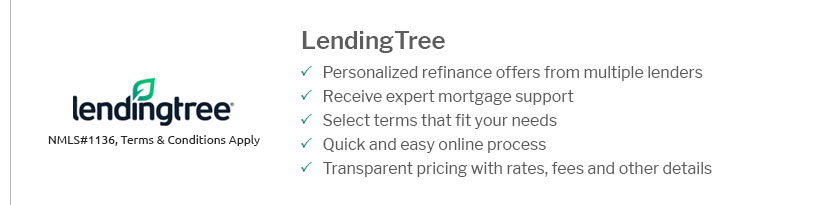

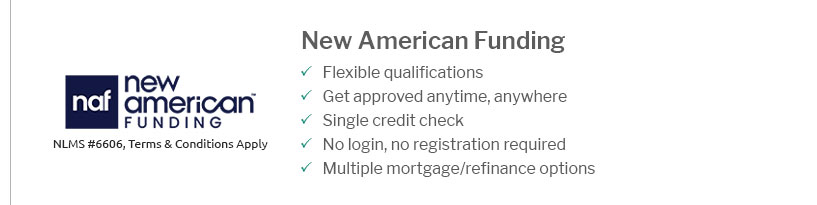

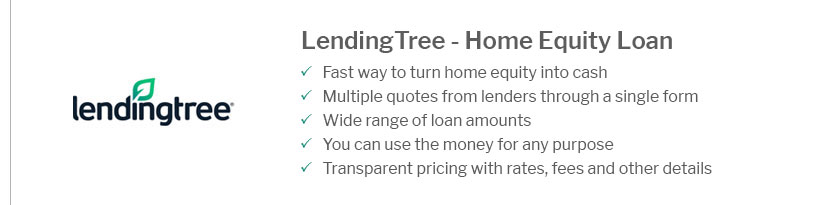

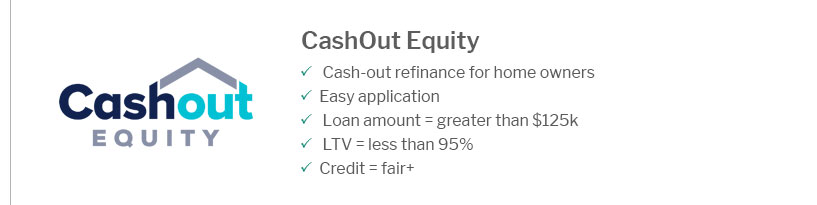

The Best Mortgage Rates in Iowa: A Comprehensive GuideUnderstanding Mortgage RatesWhen considering purchasing a home in Iowa, understanding mortgage rates is crucial. Mortgage rates are influenced by various factors including economic conditions, lender policies, and individual credit scores. Knowing how these elements work together can help you secure the best rates available. Factors Affecting Mortgage RatesEconomic IndicatorsEconomic indicators such as inflation, employment rates, and the Federal Reserve's monetary policy play a significant role in determining mortgage rates. A strong economy generally leads to higher rates. Lender Specific PoliciesDifferent lenders may offer varying rates. It's important to compare offers from multiple lenders to ensure you're getting the best deal. Consider visiting home loan mortgage refinance mortgage for competitive refinancing options. Credit Score ImportanceYour credit score is a critical factor. A higher score can lead to lower interest rates, saving you money over the life of your loan. Types of Mortgage RatesFixed-Rate MortgagesFixed-rate mortgages offer the same interest rate for the entire term of the loan, providing stability and predictability for budgeting. Adjustable-Rate Mortgages (ARMs)ARMs typically start with lower rates than fixed-rate loans but can change over time, which might lead to higher payments in the future. Tips for Securing the Best Rates

For those interested in exploring more lender options, consider the services of mortgage lenders daytona beach for expert advice. FAQ

https://www.bankrate.com/mortgages/mortgage-rates/iowa/

As of Thursday, March 20, 2025, current interest rates in Iowa are 6.88% for a 30-year fixed mortgage and 0.00% for a 15-year fixed mortgage. https://www.usbank.com/home-loans/mortgage/mortgage-rates/iowa.html

Learn more about U.S. Bank's current mortgage rates in Iowa and see how residing in different states can impact your loan. https://www.nerdwallet.com/mortgages/mortgage-rates/iowa

Today's mortgage rates in Iowa are 6.920% for a 30-year fixed, 5.966% for a 15-year fixed, and 7.225% for a 5-year adjustable-rate mortgage (ARM) ...

|

|---|